Form 1099-K Deep Dive

Did You Receive a Form 1099-K? Here's What You Need to Know

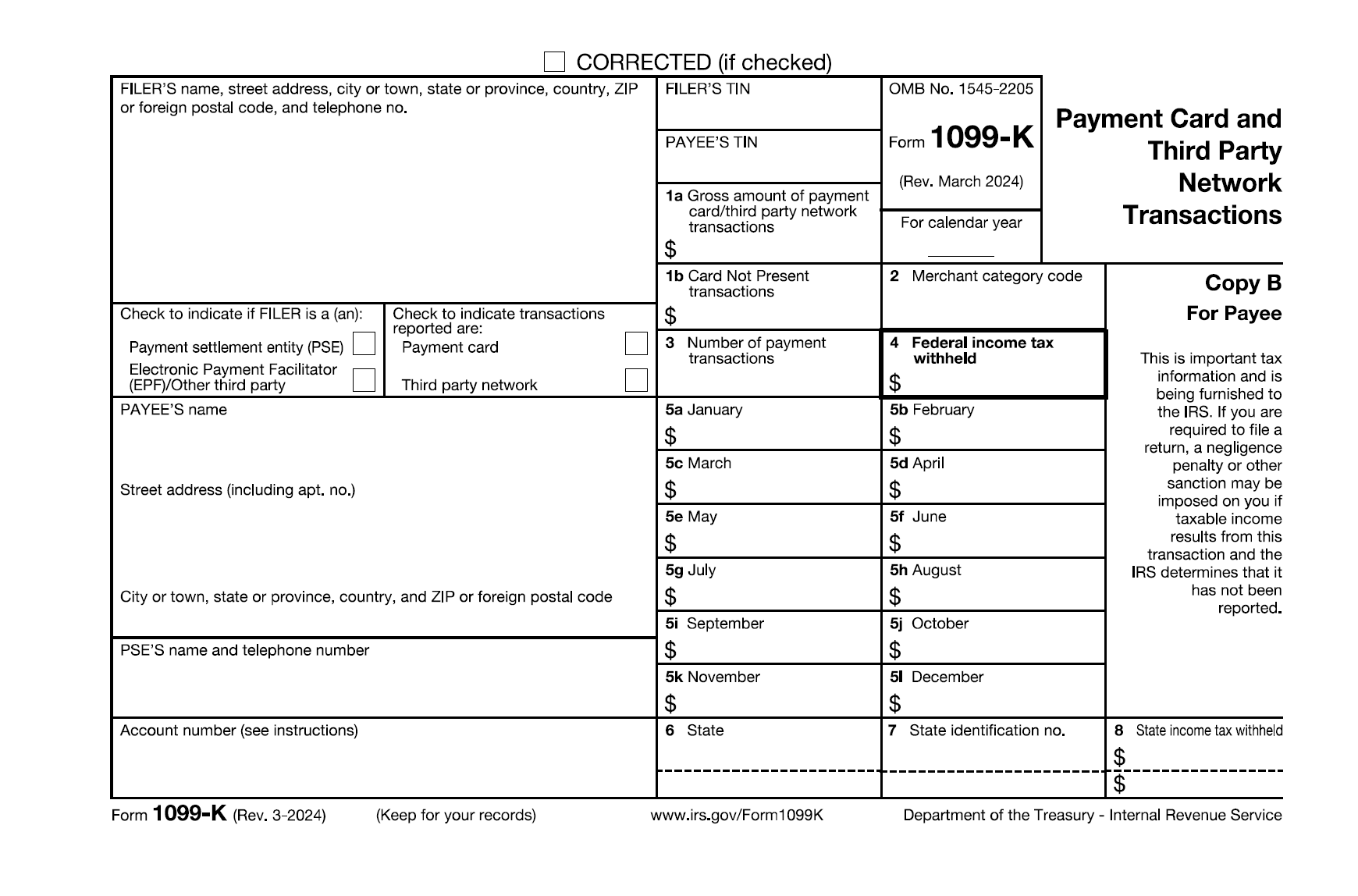

Receiving Form 1099-K can be confusing, especially if you're not sure about the accuracy of the reported information. This guide clarifies what to do next, particularly if your Form 1099-K has incorrect details.

Checking the Accuracy of Your Form 1099-K

Ensure the information on your Form 1099-K is correct by verifying:

- Payee’s Taxpayer Identification Number (TIN):

- Usually the last four digits of your Social Security number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN).

- If your name and TIN appear on the form, but you report business income with Form 1120, 1120-S, or 1065, request a corrected Form 1099-K.

- Gross Payment Amount (Box 1a):

- This amount includes total payments processed through payment card or third-party network transactions.

- The gross amount does not account for deductions such as fees, credits, refunds, shipping costs, cash equivalents, or discounts.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered tax, legal, or financial advice. Tax laws and regulations are subject to change, and individual circumstances may vary. Always consult a qualified tax professional for specific guidance regarding your tax situation. Copper River Tax is not responsible for any errors, omissions, or reliance on the information presented.