2025 TAX YEAR • EV Clean Vehicle Credit

EV Tax Credit Sunset: Confirm Your Order & Delivery Dates (2025 Tax Year)

If you bought an EV in 2025 and received an upfront discount at the dealer (transfer election), your paperwork is not “done” until you file your 2025 federal tax return (due 4/15/2026 for most individuals). The 2025 rule change also makes your order date and delivery (possession) date especially important.

The Clean Vehicle Credit (Section 30D) can be claimed only for the year the vehicle is placed in service (generally when you take possession). If you elected to transfer the credit at point-of-sale, the IRS expects specific forms and documentation on your 2025 return.

Program sunset: September 30, 2025 cutoff

The IRS has stated the New Clean Vehicle Credit is not available for vehicles acquired after Sept. 30, 2025. If your vehicle was placed in service after Sept. 30, 2025, eligibility generally depends on whether you acquired the vehicle on or before Sept. 30, 2025—often demonstrated by a binding written contract and a payment made by that date.

What you should confirm (do this before filing)

To avoid IRS notices, delays, or repayment surprises, confirm these dates and documents now—especially if you ordered in 2025 but took delivery later.

- Order / contract date: Keep the signed purchase agreement (and any addenda). If you are relying on a “binding written contract,” retain proof it was executed on or before 9/30/2025.

- Payment date: Save proof of payment (deposit, down payment, or other qualifying payment) and the transaction date—especially if it occurred close to 9/30/2025.

- Delivery / possession date (placed-in-service): Document when you actually took possession (delivery date, pickup date, signed delivery paperwork). The credit is claimed on the tax return for the year the vehicle was placed in service.

- Dealer / seller report: If you transferred the credit, request a copy of the accepted seller report and keep it with your tax records. Make sure the VIN and buyer information match your return.

Forms you typically must file (when you transferred the credit)

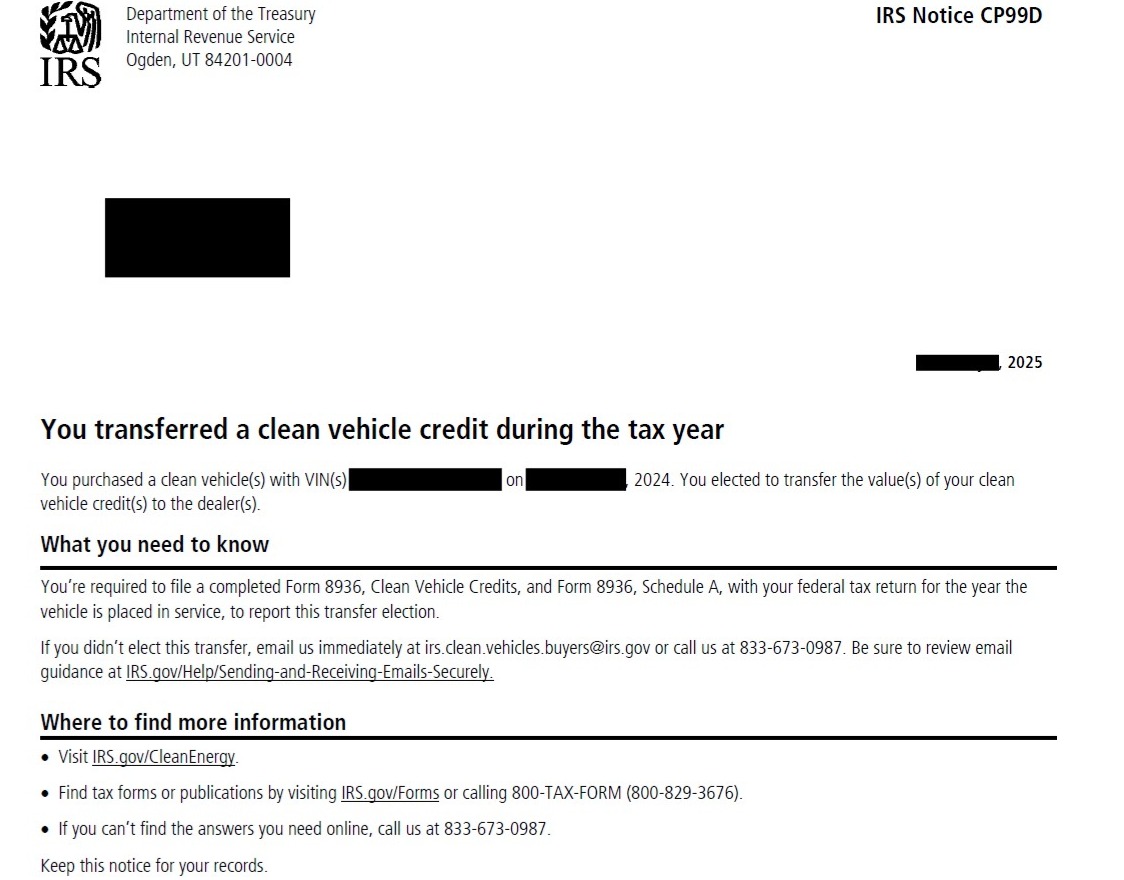

If you received IRS Notice CP99D, treat it as a reminder that your 2025 return should include the required clean vehicle credit reporting forms. See the IRS guidance here: Understanding your CP99D notice .

- Form 8936: Clean Vehicle Credits (required to report the credit and transfer election, as applicable).

- Form 8936 Schedule A: Clean Vehicle Credit Amount (typically required with Form 8936 for transfer reporting).

- IRS Online Account: You may also see notices or account activity online: IRS online account

Common problems we see

- Customer assumes the point-of-sale discount means “no paperwork required.”

- VIN mismatch between buyer documents, dealer report, and the tax return.

- Order date vs. delivery date confusion near the Sept. 30, 2025 cutoff.

- Missing CP99D-related documentation and incomplete Form 8936 / Schedule A.

Need help filing your 2025 return with EV credit documentation?

Copper River Tax can help you reconcile your CP99D notice, dealer documentation, and your 2025 return to minimize delays and reduce the risk of repayment or IRS correspondence.

File 2025 taxes with Copper River TaxContact UsDisclaimer: The information provided in this article is for general informational purposes only and should not be considered tax, legal, or financial advice. Tax laws and regulations are subject to change, and individual circumstances may vary. Always consult a qualified tax professional for specific guidance regarding your tax situation. Copper River Tax is not responsible for any errors, omissions, or reliance on the information presented.